Why Choose Bharti AXA Life Growth Shield Plus?

You can now Protect your loved ones while multiplying your wealth. Bharti AXA Life Growth Shield Plus

gives you up to 100X life cover benefit of a term plan with the Wealth creation power of ULIP

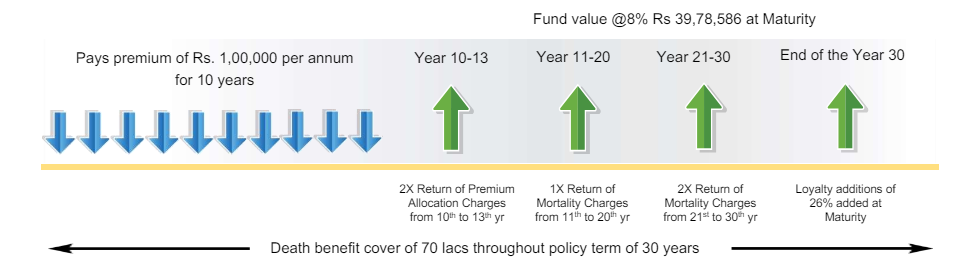

- Return of 2X premium allocation charge

Premium allocation charges are deducted on the premiums paid during the 1st to 4th year of the policy term. 200% of these charges shall be added back to your policy’s fund value from end of 10th year to 13th year.

-

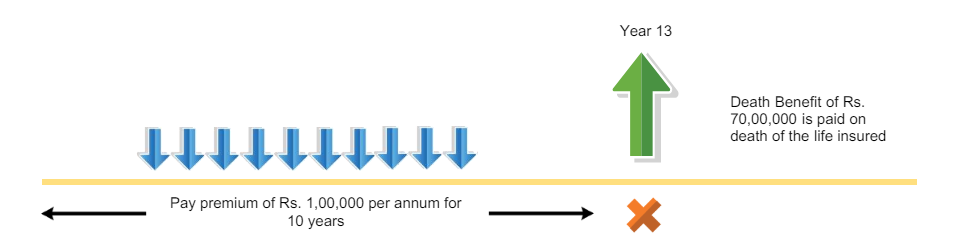

Up to 3X Return of Mortality charges

Mortality charges are deducted during the policy term. 100% to 300% of these charges (depending upon the policy term) shall be added back to the fund value from the end of the 11th policy year.

-

Up to 30% Loyalty Additions on Maturity

Loyalty Additions shall be added to the Policy as % of average Fund Value of three years at maturity depending upon the Policy Term and Premium Payment Term opted by the Policyholder.

-

Multiple Investment Strategies to suit your investment needs

The plan lets you choose from 2 investment strategies - Dynamic Fund Allocation and Systematic Transfer Plan along with multiple fund options basis the investment goals and risk-return potential.

-

Tax Benefits*

You can avail the tax benefits on the premiums paid and the benefits received; subject to the prevailing provisions under Income Tax Act, 1961. The tax benefits are subject to change as per change in Tax laws from time to time.

Key Benefits

Return of 2X premium allocation charge

Upto 3X Return of Mortality Charges

Up to 30% Loyalty Additions

Multiple Investment Strategies

Tax Benefits*

How Does the Plan Work?

IN THIS POLICY, THE INVESTMENT RISK IN INVESTMENT PORTFOLIO IS BORNE BY THE POLICYHOLDER

Make your plan with ease

Pick your policy term

Choose one of the options, as per your financial goals.

30 Years

Premium payment term of 10 or 30 years.

35 Years

Premium payment term of 10 years.

40 Years

Premium payment term of 10 or 40 years.

30 Years

Choose from premium payment term options of 5, 7, 10, or 15 years.

30 Years

Premium payment term of 10 or 30 years.

35 Years

Premium payment term of 10 years.

40 Years

Premium payment term of 10 or 40 years.

30 Years

Choose from premium payment term options of 5, 7, 10, or 15 years.

Now, add a rider

For added protection, the following rider can be availed by paying additional premium along with Bharti AXA Life Wealth Maximizer.

Bharti AXA Life Linked Complete Shield Rider (130A012V02):

Receive additional sum assured chosen under the rider in case of happening of a covered event.

Please refer to rider brochure for complete details on terms and conditions and exclusions before opting for the rider.

Insurance Jargon Explained

Maturity benefit

It is the amount which the insurance company pays to the policy holder on the completion of the Policy Term, if the Life Insured has survived the entire duration of the Policy.

Riders

A provision attached to a policy that adds benefits not available in the original policy or that changes the original policy.

Riders help the Policyholder in enhancing the insurance product to meet specific needs by adding protection benefits to the basic Insurance Plan at a lower additional cost.

Premium

The payment, or one of the regular periodic payments, that a policyholder makes to an insurer in exchange for the insurer's obligation to pay benefits upon the occurrence of the contractually-specified contingency (e.g., death).

Sum Assured

Sum assured is the amount that an insurer agrees to pay on the occurrence of a stated contingency (eg: Death).

Disclaimer :

Life insurance coverage is available under this policy.

Unit Linked Life Insurance products are different from the traditional products and are subject to market risks.

The premium paid in Unit Linked Insurance policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the insured is responsible for his/her decisions.

Bharti AXA Life Insurance Company Ltd. is only the name of the insurance company and Bharti AXA Life Growth Shield Plus (130L123V01) is only the name of of the unit linked, non-participating individual life insurance plan and does not in any way indicate the quality of the contract, its future prospects or returns.

Please know the associated risk and applicable charges from your Insurance Advisor or the intermediary or the policy document issued by the insurance company.

The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their future prospects or returns.

The funds do not offer a guaranteed or assured return.

Past performance of the Fund Options is not indicative of future performance. All benefits payable under this policy are subject to tax laws and other fiscal enactments in-effect from time to time, please consult your tax advisor for details.

For more details on risk factors, terms and conditions please read sales brochure carefully before concluding a sale.

* Tax benefits are as per the Income Tax Act, 1961, and are subject to any amendments made thereto from time to time.

~ For Male age 35, online purchase of the policy, Life cover of Rs 84 lacs (till the end of the policy term)