What is Whole Life Insurance Policy?

A whole life insurance policy is a contract between the insurer and the insured that generally lasts until the policyholder reaches the age of 100 years. The policyholder is provided life coverage in exchange of timely payment of premiums. A whole life insurance policy provides lump sum amount of money to the policyholder’s family as death benefits in case of an uncertain event of the policyholder’s death. Whole insurance plans also provide maturity benefits apart from the death benefit. A life insurance policy is also an ideal means of saving your hard-earned money.

What is Term Insurance Policy?

A term insurance policy is where the policyholder is eligible for the policy cover for a specific term. Moreover, with a term insurance policy, there are no maturity benefits. In a term insurance policy, the policyholder’s family receives a lump sum amount of money as death benefits.

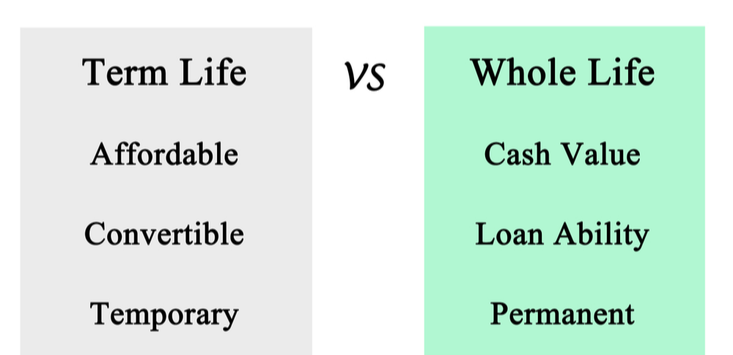

Whole Life Insurance vs Term Insurance: What’s the Differences

Let us now understand the difference in the case of life insurance vs term insurance.

1. Tenure of the Policy

In the case of whole life insurance vs term insurance, a whole life insurance policy usually provides flexible tenure and may be applicable up to the age of 100 years of the policyholder, or till death of the policyholder, whichever is earlier

On the other hand, term insurance has a fixed tenure of 5 years, 10 years, 15 years, etc.

2. The Amount of Premiums

Another difference in the case of life insurance vs term insurance, term insurance policy has a lower amount of premium. It is much more affordable as compared to the whole life insurance policy.

In the case of term insurance, the entire amount of premium is used for life cover. Whereas in the case of whole life insurance, a certain part of the premium paid is allocated for life cover. The remaining amount of the premium is used for investment in the market, as shares, stocks, bonds, equity, etc and provide fixed returns in the form of maturity benefits.

3. Financial Estimate

One of the crucial differences between whole life insurance and term insurance is the difference of financial estimates in both policies. In the case of whole life insurance, the premiums are not only used for insuring the policyholder and his family, a part of the premiums are also used to invest in the market in the form of bonds, shares, stocks, etc. Therefore, the financial value of the whole life insurance builds gradually. In the case of term insurance, the premiums are only used for insuring the policyholder and his family and there is no provision of investing your money either.

The policyholder can benefit from applying for a loan with whole life insurance, whereas there is no such provision in the term insurance policy.